One of the most talked about aspects of the Tax Cuts and Jobs Act (TCJA) were the changes made to business meals and entertainment expenses. With changes in law, come the necessary changes in how these expenses should be categorized on your books. Appropriate time should be taken in the current year to group expenses accordingly, which will lead to the proper deductions on your tax return.

It is expected that this area will be heavily scrutinized by the IRS in the coming tax years. As a reminder, under the current and previous tax laws, documentation of the amount, time, date, place, parties involved, and the purpose are required for these types of deductions to be allowable.

At a top level, the majority of meals are now 50% deductible and entertainment expenses have become nondeductible. There has been no change in meals in which no business was transacted, these expenses were never deductible and should be classified as entertainment.

The position on the deductibility of business meals has evolved since January, 2018. The AICPA has taken the position that business meals which (1) take place between a business owner or employee and a current or prospective client; (2) are not lavish or extravagant under the circumstances; and (3) where the taxpayer has a reasonable expectation of deriving income or a business benefit from the encounter are 50% deductible. The IRS has yet to provide a final determination on the above and it is not expected in the near future.

Entertainment items are now nondeductible. Examples of entertainment expenses include amusement or recreation expenses, as well as tickets to sporting events, transportation to sporting events, cover charge, taxes, tips, parking for entertainment events, nightclubs, and cocktail lounges.

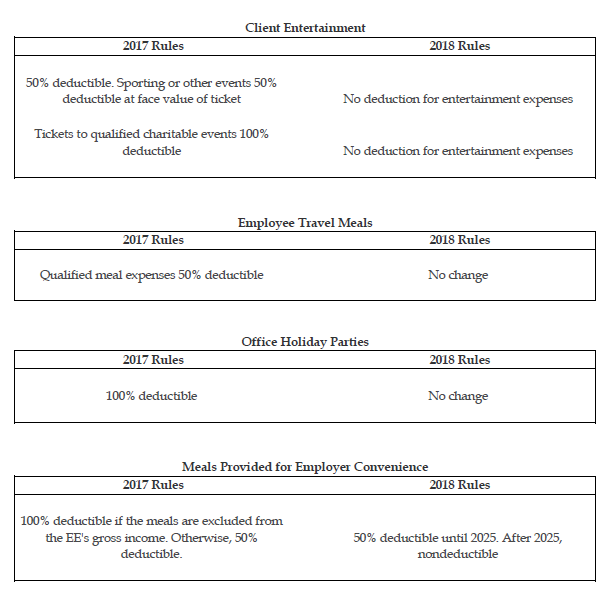

There has been no change in the deductibility of employee travel meals or office holiday parties. Meals provided for employer convenience will remain 50% deductible until 2025, after that point, they will be nondeductible.

Below is a summary of the highlights of the changes in meals and entertainment expense.

The classification of your meals and entertainment expenses will impact your taxable income in 2018, if you have any questions concerning how your expenses should be categorized, please contact us.

Jay Brooks, CPA

610-687-1600

Recent Comments